Retiree Health Insurance of Choice for Healthcare workers. "Straight Medicare".

Are you turning 65 years young or older?

Millions of healthcare workers have had experience with Medicare from the provider side such as doctors, nurses, specialists, OT's, PT's and the rest. It is estimated that 94% of the U.S. Healthcare System accepts assignment from Medicare. Whether providers are participating or non-participating, all are able to electronically file a claim and bill the Centers for Medicare and Medicaid(CMS) to be paid for their medical services to beneficiaries. This is an important distinction for healthcare retirees choosing Original Medicare overwhelmingly as their primary health insurance because many healthcare retirees know how medical bills are reviewed and paid from "Straight Medicare". It isn't always the highest payer to specific healthcare providers like for chiropractic services but CMS does offer the largest and most extensive single payer Fee-For-Service-Program in the U.S. for healthcare insurance coverage known at Original Medicare.

Are there alternatives to Original Medicare?

Yes. Medicare Advantage(Part C) is the optional alternative to Original Medicare. Since network health plans like HMO's & PPO's are more affordable due to Medicare paying the health insurance companies to take on the risk of beneficiaries' health care costs, it has been a viable option for retirees who cannot afford Original Medicare plus a Medicare Supplemental Insurance Plan known as Medigap. However, some of the restrictions are concerning to many seniors on Medicare. More on top concerns for seniors below on the 2 main ways to get your retiree health insurance.Another possible option is sometimes known as "Retiree Insurance". These health insurance coverages and programs are specific to state, federal or union employees based upon years of service. Many retirees should analyze their Retiree Insurance vs the Marketplace Medicare Insurance options. I posted about Retiree Insurance for the State of South Carolina Retirees here. Posted about a doctor and his wife who were new to Medicare but found out they would be overpaying $1000+ per month in this post here. Many former healthcare workers like nurses, physicians, PT's, OT's & other healthcare workers have overwhelming choosen "Straight Medicare" benefits with Supplemental Insurance coverage for many years now.

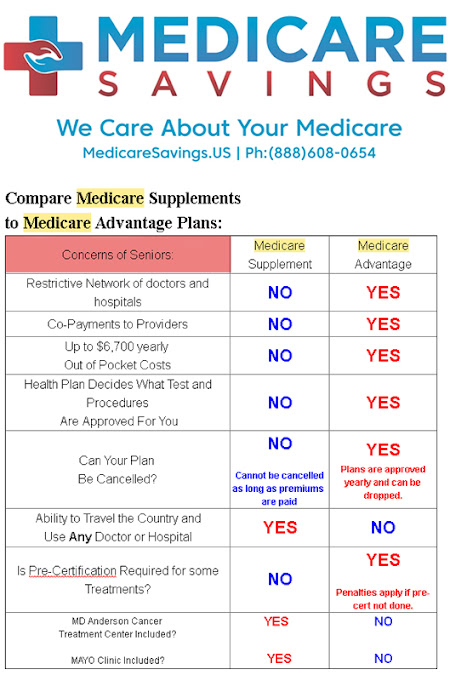

What are the TOP concerns from Americans on Original Medicare vs Medicare Advantage?

When polled retired Americans who are on Medicare shared their top concerns between Original Medicare tied with a Medicare Supplement(Medigap) Plan vs Medicare Advantage below. Since Original Medicare has gaps in coverage, Medigap Plans are standardized and designed to cover and pay for things like co-pays, coinsurance and deductibles to offer beneficiaries comprehensive coverage no matter which insurance company offers these type of supplemental plans. They must pay out by law after Original Medicare Part A & B pay their share. This is why Medicare Supplements Plan F, G and N are so popular as comprehensive coverage as the secondary to "Straight Medicare". Medicare Supplements vs Medicare Advantage top senior concerns chart below reflects the 2 main options seniors choose for their retiree health insurance.Which option do most Americans and retirees choose?

Nearly 2/3's of the 60 million plus beneficiaries choose Original Medicare as their primary health insurance. Original Medicare is accepted by millions of healthcare doctors, providers and medical suppliers nationwide. Although Medicare offers 2 main ways to get health insurance, Original Medicare dominates the marketplace for retiree health insurance in terms of sheer size and scope of coverage than any individual or group retiree health insurance plan. Medicare Advantage Plans have over 3700 variations in network size and coverage due to much smaller networks that service beneficiaries locally, within a particular region or specific eligible group. Checkout the public data CMS shows below to get a better picture of Medicare as a whole.

Above is the 2018 Medicare landscape. Note that 64% of beneficiaries chose Original Medicare(Fee-For-Service Program affectionately known at "Straight Medicare" from healthcare workers). Below is a sample of new Medicare enrollees choosing Medicare Supplment(Medigap) plans in 2014. As expected, Florida continues to be the unofficial Medicare beneficiary capital of the U.S. with over 730,177 new enrollees into Original Medicare with a Medigap Plan(Nationwide Secondary Supplemental Insurance Policy) in 2014. There are more beneficiaries per capita in the state of Florida than any other state and this trend continues today. But the Southeast coastline states like Georgia, South Carolina and North Carolina are seeing a major influx of retirees in recent years.

- Beneficiaries must apply to enroll into Medicare Part A & B through Social Security Administration whether they pick Original Medicare or Medicare Advantage. Call SSA 1-800-772-1213 or Go to SSA.gov/benefits/medicare

- Medicare.gov and MyMedicare.gov are official U.S. govt online resources for beneficiaries who chose Original Medicare as their primary. Plus you get 24/7 365 days Medicare Hotline Support at 1-800-MEDICARE(633-4227). Pro tip: Have your info ready and say "Agent" 2 or 3 times to speak with a live Medicare Agent during the initial tele-prompts.

- Medicare.gov does NOT offer Medicare Supplement(Medigap) Insurance enrollment on their website.

- MedicareSavings.US offers Medicare Supplement Insurance Options Nationwide.(Non-government retiree resource) for individuals, retiree groups & U.S. Employers with retirees that are Medicare-Eligible. They also have a trusted affiliate for all 50 states for Medicare Advantage Plans. Call 1-888-608-0654 to make an over-the-phone appointment.

- Medicare.gov does offer individual Medicare Advantage Plan enrollment into HMO and PPO health plans with drug coverage nationwide. Click on "Find Plans" button. Remember, you are choosing for Medicare to pay the insurance companies to manage your health care costs throughout your Medicare Journey as the optional alternative. ***Look at Seniors Top Concerns Chart Above***

- Medicare is the official administrator for Part D drug plans nationwide. Medicare tracks Part D enrollment and spending for all beneficiaries. So most folks enroll and shop their stand alone Part D(Pharmacy card) drug coverage yearly on their MyMedicare.gov account. This is for folks who have Original Medicare as their primary but want drug coverage as well.**Be aware of the possible penalties for not enrolling into a Part D drug plan outside of your enrollment period**

- Why navigate Medicare alone? Get Help from a trusted friend, family or Medicare Insurance Broker. Medicare Savings out of Charleston, South Carolina is a FREE nationwide service to help beneficiaries enroll into their Original Medicare benefits along with making it easy to enroll into your Medicare Supplement Insurance Plan of their choice. We help to manage your Medicare Savings when possible. Don't be hassled. Make Medicare enrollment & insurance shopping easy with an independent brokerage. Call to make an appointment to get your Medicare help.

- Medicare Supplement Enrollment is the easiest part of your transition to Medicare. Many retirees enroll 6-4 months in advance to ensure cross-claims with Medicare is setup and ready. Call Medicare Savings 1-888-608-0654 to make an appointment.

- Medicare Part A and Part B Enrollment through Social Security Administration should be done 3 to 1 month prior to Medicare Part B effective date. Enrolling into your Part B during or after your 65th birth month can cause a delay in your Part B start date. Avoid this by enrolling early.

- Medicare Part D(Drug Coverage) Enrollment can easily be done on your MyMedicare.gov account or thru 1-800-MEDICARE(633-4227) 3 to 1 month prior to Medicare Part B effective date. **MedicareSavings.US does a FREE Part D analysis for policyholders that have a Medicare Supplement as a free benefit to client members**. NOTE: Some beneficiaries may have sticker shock because their tier 3, 4 or 5 expensive Rx medication may have been covered by their group health insurance plan from their former employer. Always compare the retail(cash) cost vs Medicare Part D plans. There maybe some manufacturer or Part D Help programs available in your state to help for Rx costs. Call 1-800-MEDICARE for Part D Plan(PDP) help 24/7 365 days out of the year.

Michael C. Fischbach

Owner/Operator of Medicare Savings

I've spoken to numerous healthcare worker retirees. Many healthcare retirees continue to choose Original Medicare plus a supplement for their Medicare Insurance option of choice. Some healthcare retirees are eligible for state or federal retiree group health insurance due to years of service. The decision is always yours to make because you have the right to choose your Medicare insurance path. Be a smart consumer and know the pros and cons of your Medicare insurance paths for your retiree health insurance in your State.

No comments:

Post a Comment